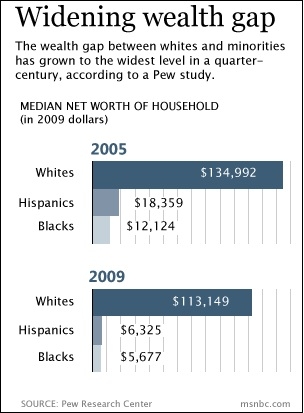

These lopsided wealth ratios are the largest since the government began publishing such data a quarter century ago and roughly twice the size of the ratios that had prevailed between these three groups for the two decades prior to the Great Recession that ended in 2009.

The analysis finds that, in percentage terms, the bursting of the housing market bubble in 2006 and the recession that followed from late 2007 to mid-2009 took a far greater toll on the wealth of minorities than whites. From 2005 to 2009, inflation-adjusted median wealth fell by 66 percent among Hispanic households and 53 percent among black households, compared with just 16 percent among white households.

Hispanics and blacks are the nation’s two largest minority groups, making up 16 percent and 12 percent of the U.S. population respectively.

Plummeting house values were the principal cause of the recent erosion in household wealth among all groups, with Hispanics hit hardest by the meltdown in the housing market.

Other key findings from the report:

Hispanics: The net worth of Hispanic households decreased from $18,359 in 2005 to $6,325 in 2009. The percentage drop—66 percent—was the largest among all groups. Hispanics derived nearly two-thirds of their net worth in 2005 from home equity and are more likely to reside in areas where the housing meltdown was concentrated. Thus, the housing downturn had a deep impact on them. Their net worth also diminished because of a 42 percent rise in median levels of debt they carried in the form of unsecured liabilities (credit card debt, education loans, etc.).

Blacks: The net worth of black households fell from $12,124 in 2005 to $5,677 in 2009, a decline of 53 percent. Like Hispanics, black households drew a large share (59 percent) of their net worth from home equity in 2005. Thus, the housing downturn had a strong impact on their net worth. Blacks also took on more unsecured debt during the economic downturn, with the median level rising by 27 percent.

No Assets: about a quarter of all Hispanic (24 percent) and black (24 percent) households in 2009 had any assets other than a vehicle, compared with just 6 percent of white households.

Wealth Disparities within Racial and Ethnic Groups: During the period under study, wealth disparities increased not only between racial and ethnic groups, they also rose within each group. Even though the wealthiest 10 percent of households within each group suffered a loss in wealth from 2005 to 2009, their share of their group’s overall wealth rose during this period. The increase was the greatest among Hispanics, with the top 10 percent boosting their share of all Hispanic household wealth from 56 percent in 2005 to 72 percent in 2009. Among whites, the share of wealth owned by the top 10 percent rose from 46 percent in 2005 to 51 percent in 2009.

Source: Pew Research Center, “Wealth gaps rise to record highs between Whites, Blacks, Hispanics” July 26, 2011.